Like all nations, Kenya has been founded on the efforts of many people, institutions, organizations, corporations and professions. One of the foundations upon which the nation has been built is the banking profession and the banks and institutions through which that profession is practiced.

Banking in Kenya has contributed tremendously to the growth of the national economy and the well-being of millions of Kenyans since before the county’s independence on December 12th, 1963.

Timeline

Decades of Banking Industry Transformation

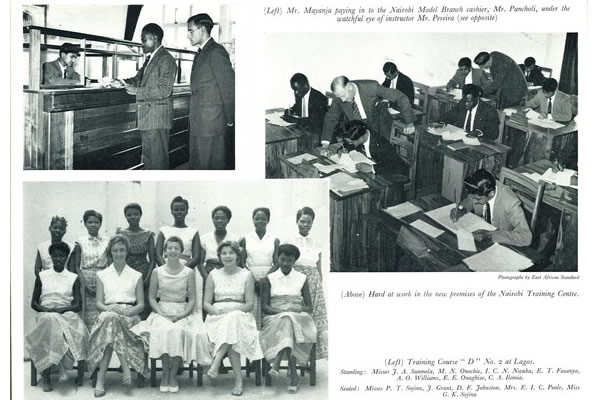

Photo Gallery